Introduction

Today’s investors use websites to carry out most of their investments, and over

70% of them use Google Finance to track them. Google Finance Investor

Tracker can be considered a unique and helpful tool for investors with little

experience and those who are more experienced, as it provides real-time

portfolio tracking, tools for analysing the stock market, and critical financial news.

Whether a user is to follow the movement of stock, mutual funds, or

cryptocurrencies, Google Finance offers the necessary tools to make correct

estimations and track the changes. However, if one wants to get the most out of

the system, the authors must know how to employ it properly.

In this article, I’ll explain and share five valuable rules that will help you get the

most from Google Finance Investor Tracker and use it as a powerful tool for

personal finance development.

1. Setting up a customised Investment Portfolio

Creating an individual Customized portfolio is the first step towards effective

investment management using Google Finance. You must sign in to Google to

create a Google Finance portfolio setup platform, which requires a Google

account.

After logging into the application, go to the “Portfolios” section to import your

preferred securities, including stocks, mutual funds, and cryptocurrencies. When

you add your particular investment options to a portfolio of your choice, you have

a personalised workspace that exhibits results immediately and reflects your

financial planning.

That is why the degree of customisation should be as high as possible; it gives

much more attention to the assets seen as the most important for achieving long-

term or short-term objectives.

Another feature available via Google’s dashboard is the ability to create multiple

portfolios and track them simultaneously. This is convenient for people who want

separate portfolios for different investments or purposes (for example, retirement,

saving, etc. ).

A practical tip

Configure your investment tracking tools to suit your risk level, preferred field, or

any other financial target that you may have in the future. This will allow you to

utilise investment tracking tools effectively and provide you with a better

understanding the market trends you are interested in and the selected

investment's overall performance.

2. Leverage Real-time Data and stock alerts

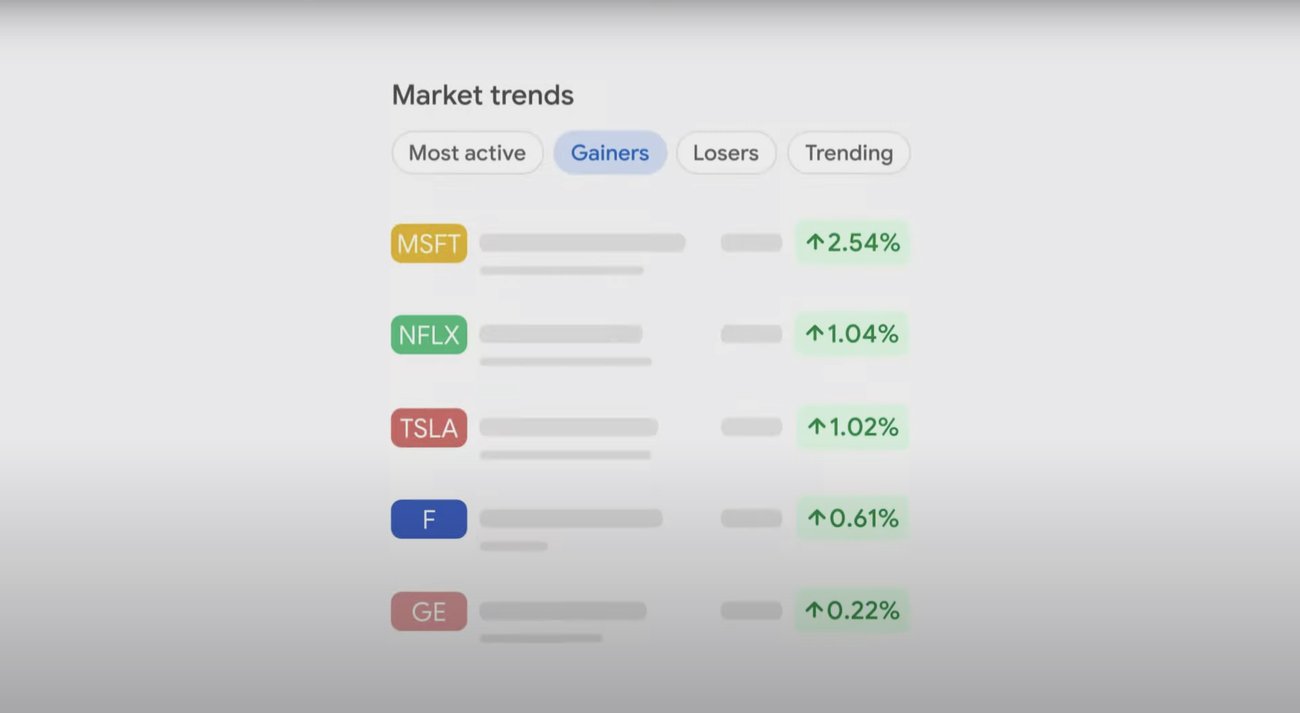

Another advantage of Google Finance is that it can provide updates on stocks in

real-time, which means that investors will always be up to date on the stock

market's happenings. Google Finance provides stock performance information

for the past, present, and future exchange rates and asset prices, enabling the

user to make a proper investment decision.

For a long-term investor, short-term trader, or whatever you may be, getting real-

time information about markets as they evolve can be very beneficial in

formulating one’s investment strategy.

For that, it’s crucial to set Google Finance stock alerts. Stream's usage can be

described as follows. These alerts let you know when specific specified prices

have been breached, assisting you in monitoring your portfolio's huge

fluctuations.

To set up Google Finance stock alerts using Google Alerts, follow these

simple steps:

Visit Google Alerts

1. Enter the Stock Name or Ticker Symbol: On the search bar, enter the

company name or the symbol (for instance, “Apple stock price” or “AAPL”).

2. Customise Alert Settings:

3. You can select that often you should receive notifications (for instance,

“Each time something occurs” or “Not more than once a day”).

4. Choose your favourite sources (news, blogs, finance, etc. ).

5. Select a region or a language for further refinements.

6. Create Alert: Click the ‘Create Alert’ button. You will receive email

notifications whenever the stock gets new information.

Therefore, in revisiting our case of using Google Alerts for stocks, you can track

company performance and market changes, a precious approach to identifying

any new development that might impact stocks.

3. Utilize Financial news Integration for Smart Decisions

With Google Finance, it is easy to integrate financial news into the platform,

providing users with up-to-date news feeds from various reliable sources. This

feature enables investors to make informed investment decisions since it

features relevant information about market changes and company performance.

Staying updated with investment news on Google Finance allows it to inform its

users at any time, allowing them to adapt to changes in demand.

A short-term trader and a long-term investor must keep up-to-date with

investment news on Google Finance.

For instance, a policy change or the release of an earnings statement will cause

the stock prices to rise or fall vastly. Knowledge of such factors lets investors

respond accurately and at the right moment. Investors can use a particular

stock’s low price to buy or take advantage of a specific stock’s high demand to

sell the shares.

Practical tip

Develop the practice of turning to the ‘News’ section in Google Finance for

articles that describe the fundamental factors behind market fluctuations. This

assists you in evaluating the current environment and making good decisions

based on actual occurrences.

Being informed while using the opportunities of financial news integration can

make a radical difference in your investment experience.

4. Analyze Stocks using Google Fiance tools

Google Finance has made various stock analysis tools available to enhance your

investment significantly.

Such elements comprise Historical performance charts, financial ratios, and the

latest earnings reports, which help determine a stock's past and current

performances.

Trends may include how a company’s share has been doing over several years

or how its earnings stack up with those of other companies in the market. Thus,

trends help investors decide to invest in a company and hold it or sell their

stocks.

As one may remember, the platform compares companies and industries through

financial charts and ratios.

For example, instead of directly examining a stock graph, one can examine the

P/E ratio or the EPS, which can help determine whether the stock is overpriced.

Analysing earnings calls is also an effective way to learn about the company's

financial status.

Practical tip

Take it further with Google Finance stock by analysing more than one company

operating in the same sector. This will also assist you in deciding on better

investment strategies where your portfolio focuses on short-term gain and long-

run returns.

5. Syn Google Finance from the Mobile For Ongoing tracking

With Google Finance mobile tracking, investors who wish to keep track of their

investments at all times can access this website. If you have a Google Finance

account, you can update your stocks on your mobile phone while at the

workplace, on the move, or in any other circumstance where you are not at your

PC. This feature makes it possible to track the performance of your portfolio,

stock and all the other market-related with real-time updates.

However, synchronising your account is very easy. Just install the application on

Google Play or search for Google Finance via an internet browser on your mobile

device. Login to your Google account, monitor your customised portfolios and

assets and set alerts. This setup enables you to receive push notifications in

significant market movements and have a real-time update.

Practical tip

A mobile interface can instantly monitor the portfolio during the day. The app is

designed smartly so that users can check their investments or the latest financial

news while commuting to work or on their lunch break.

Similarly, equal notification synchrony helps you recognise any significant

market change that may call for immediate action. Mobile applications for

ongoing investment tracking have made managing investments easier.

Conclusion

In this article, I’ll explore and provide 5 tips for using Google Finance to track

investments effectively. This app is handy for a finance investor, whether it’s

stock, currency, or EEF. Use it for your investment portfolio, which gives you the

rates of ups and downs of the market and currency. Set Google alerts for the

latest news and updates from the article. Read the latest article for more

knowledge about market trends. Analyse the stock using Google tools that

provide historical data from charts and graphs. Use it on mobile devices and

access the news at any time.